flow through entity tax break

Many small businesses are set up as flow. That dollar threshold is for single.

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

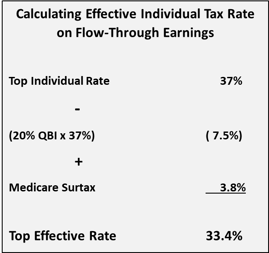

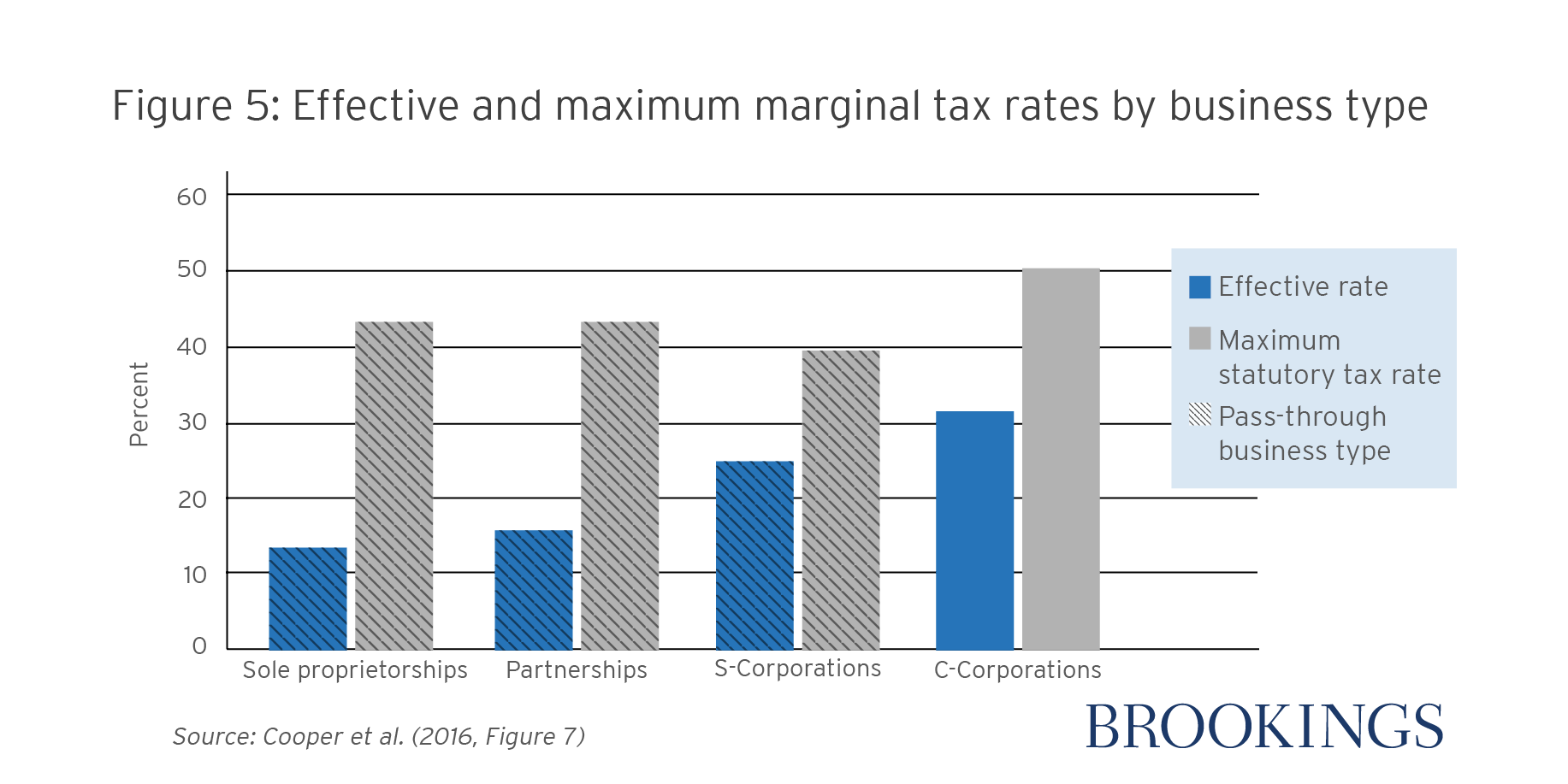

For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation.

. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan. The pass-through deduction is set to expire after 2025 unless extended by Congress. There are three main types of flow-through entities.

For 2021 the states announcement read that while the initial election into the flow-through entity tax and any payment required are due on certain dates in 2022 many flow. On Friday August 27 2021 Illinois Governor JB. Under the SALT cap owners of pass-through entities may be liable for state and.

If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the. Pritzker signed Public Act 102-0658 into law. Tax advantages The entitys income only goes through a single layer of tax rather than two.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. The Michigan FTE tax. Any payments toward a flow-through entitys 2021 calendar tax year that are made after March 15 2022 will be claimed as a credit against members 2022 tax liability.

The Tax Cuts and Jobs Act gave temporary tax breaks to individuals. Flow-through entities are considered to be pass-through entities. Understanding What a Flow-Through Entity Is.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. The Act provides a significant tax break to owners of flow through entities S corporations and. A flow-through entity is also called a pass-through entity.

In a pass-through entity also knows as a flow-through entity business income isnt taxed at the. A flow-through entity FTE is a legal entity where income flows through to investors or owners. An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a corporate tax.

Types of flow-through entities. It offered a permanent. Is elected and levied on the.

There are two major reasons why owners choose a flow-through entity. A business owned and operated by a single individual. This means that the flow-through entity is responsible for the.

Specifically the law disallowed pass-through owners from using business losses exceeding 250000 to offset non-business income. That is the income of the entity is treated as the income of the investors or owners. Income and resulting tax liability flow through to individual owners members or shareholders.

Most small businessesand quite a few larger onesare set up as pass-through entities. However the late filing of 2021 FTE returns will be accepted as timely if filed.

New Oregon Pass Through Entity Level Business Alternative Income Tax Kbf Cpas

Optional Pass Through Entity Tax Wolters Kluwer

Impact On Individuals Operating A Business Directly Or Indirectly Through A Pass Through Entity Bracewell Llp

Impact Of 2018 Tax Reform On Corporations Pass Through Entities

Choosing A Business Entity How The 2017 Tax Law Changed The Math

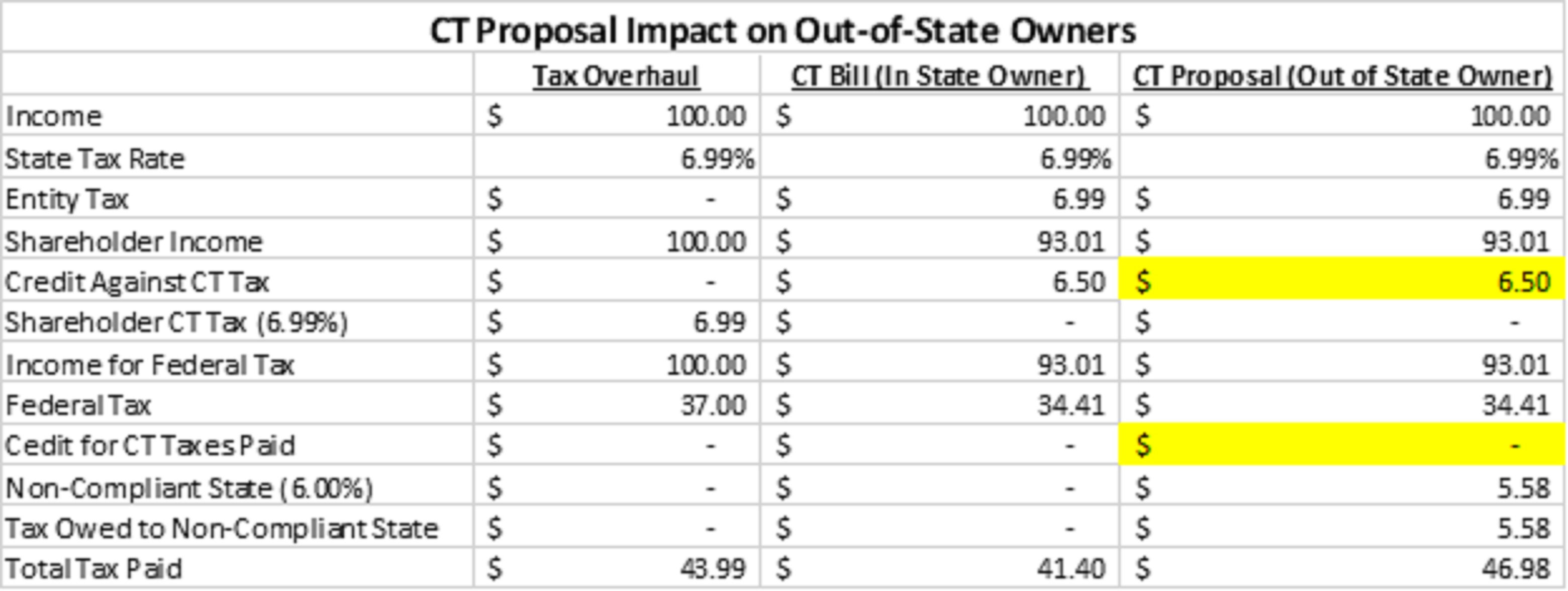

Connecticut Moves On Salt Fix For Pass Throughs The S Corporation Association

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

Virginia New Mexico Enact Pass Through Entity Elections Forvis

Electing Pass Through Entity It 4738 Department Of Taxation

Publicly Traded Partnerships Tax Treatment Of Investors

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

Michigan Fte Tax Return Format Available Clayton Mckervey

Considerations For California S Pass Through Entity Tax Deloitte Us

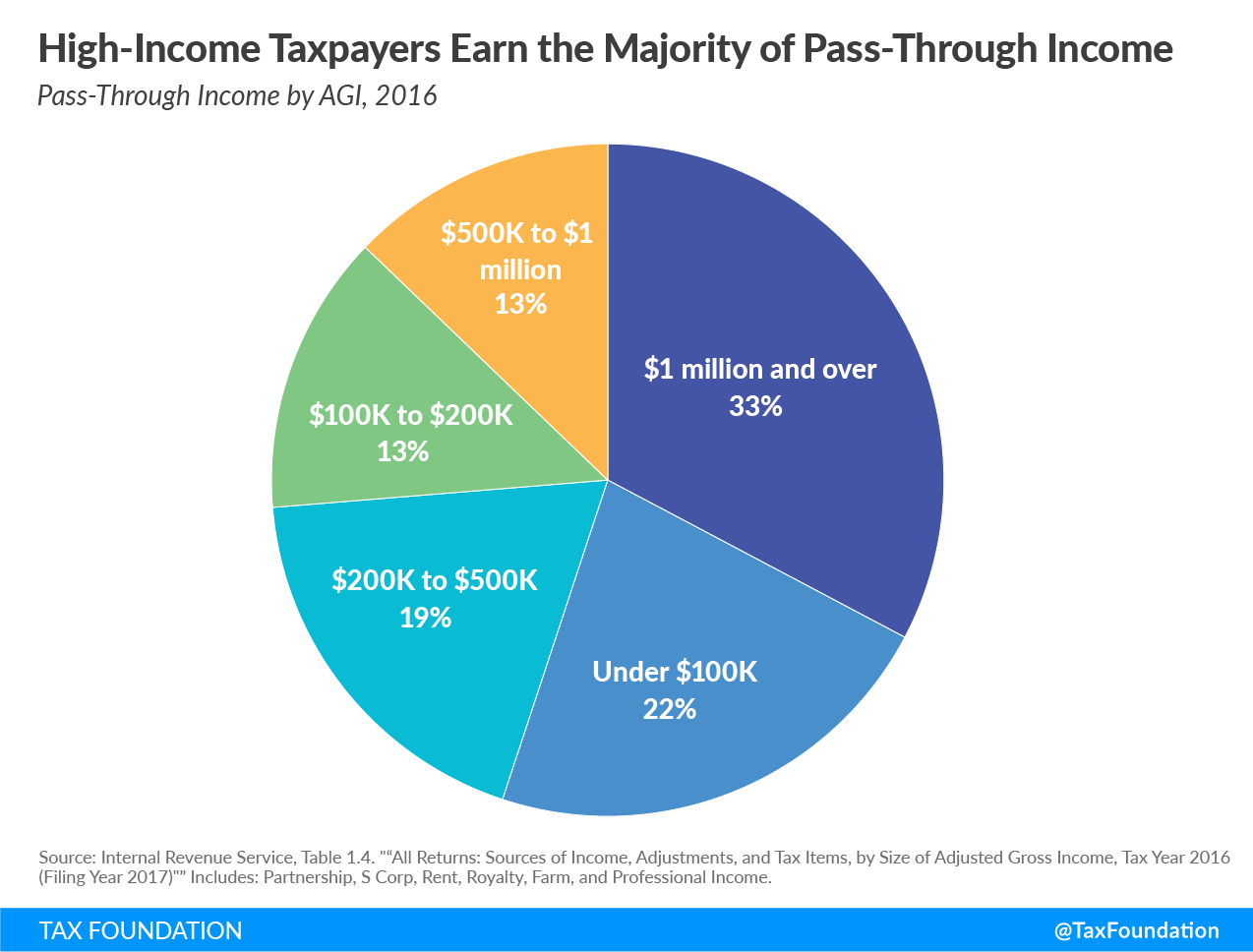

9 Facts About Pass Through Businesses

What Are Pass Through Businesses Tax Policy Center

Pass Through Entities A New Tax Break For Ohio Business Owners Bmf

What Is A Pass Through Business How Is It Taxed Tax Foundation

Pass Through Entity Tax Cut Rules Complicated For Small Businesses